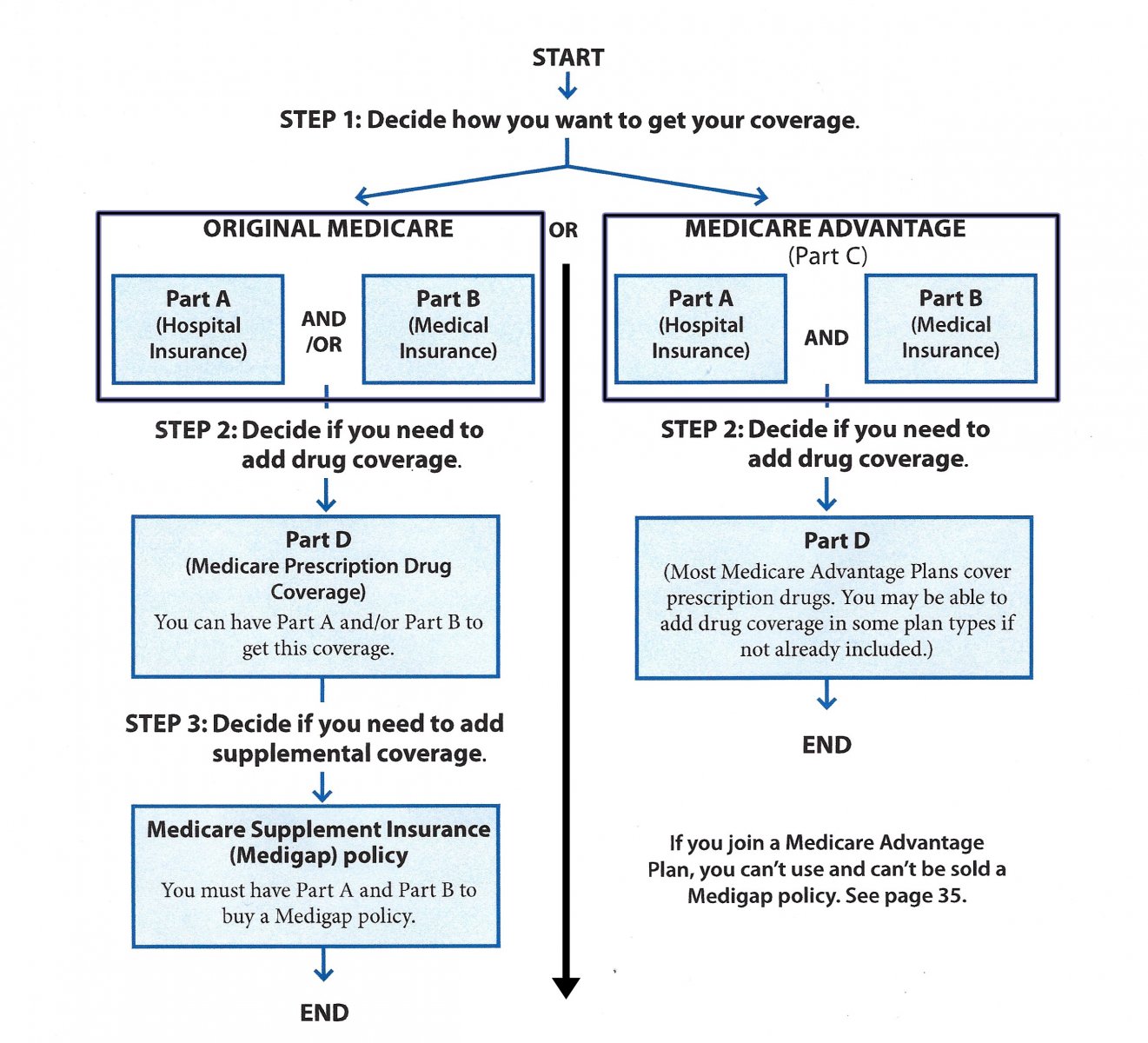

Your Medicare Summary Chart Showing Options and Choices

Medicare Summary Chart

The best way to present a summary of Medicare in My Medicare Search in is by viewing a simple chart that reviews your major options and choices.

Who is Eligible for Medicare

Generally, Medicare is available to U.S. citizens who are 65 or older. You may be able to get Medicare earlier if you have a disability, End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant), or ALS (also called Lou Gehrig’s disease).

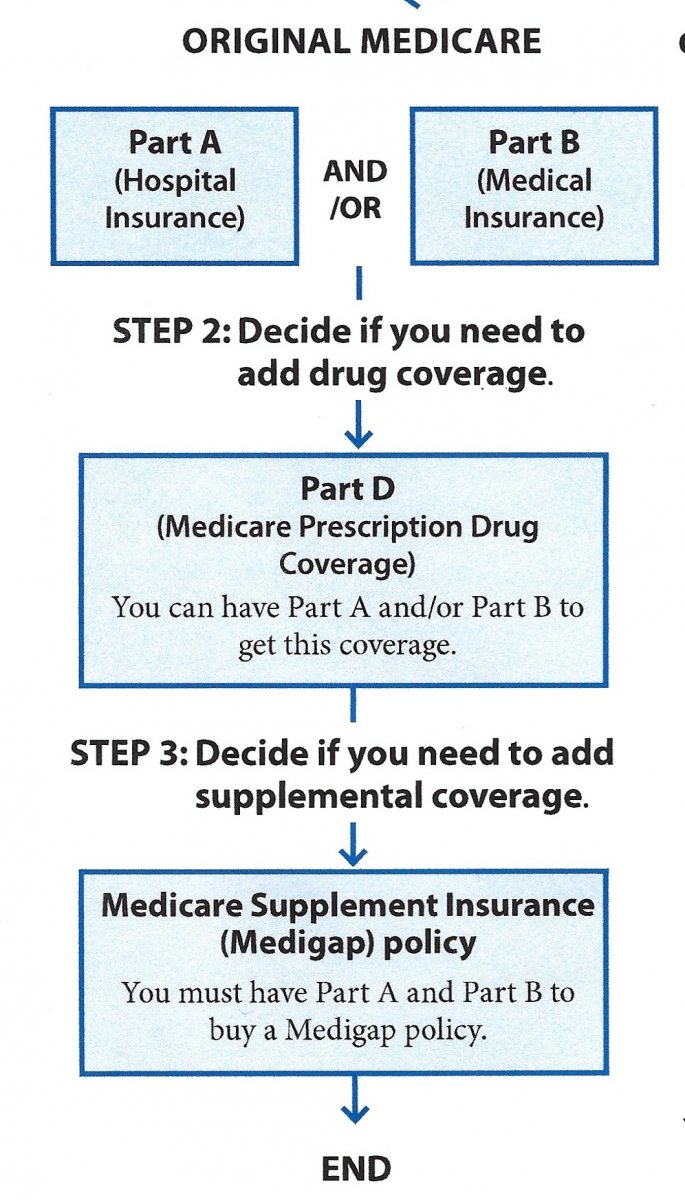

Original Medicare – Left Side of the Chart

Original Medicare

Part A hospital insurance is automatically covered under original Medicare provided through your work if you have paid into Medicare for 40 or more weeks. If you have not worked enough Medicare hours, you may pay a premium to get Part A Medicare.

Part B medical insurance is an option available to you, but you must pay a Part B premium each month. This Part B premium will be deducted from your Social Security. If you have not yet applied for Social Security, you will be billed for the Part B Premium.

So, if you choose to keep your original Medicare benefits with Part A and Part B, you will have approximately 80% of your health care costs covered. To cover some or most of the additional 20% health cost not covered by basic Medicare, you may purchase from an insurance company a Medicare Supplement Plan (also called a Medigap Policy)

Also, the basic Medicare coverage does not include prescription (Part D) coverage. You will also have to purchase a Part D prescription coverage policy if you want coverage for prescriptions.

Supplement policies and Medicare Part D Prescription Drug Plans are available from private insurance companies, which charge monthly premiums. Also, if you do not initially enroll in a Part D prescription coverage plan and later want to enroll in a Part D plan, you will have to pay a monthly penalty.

More Information

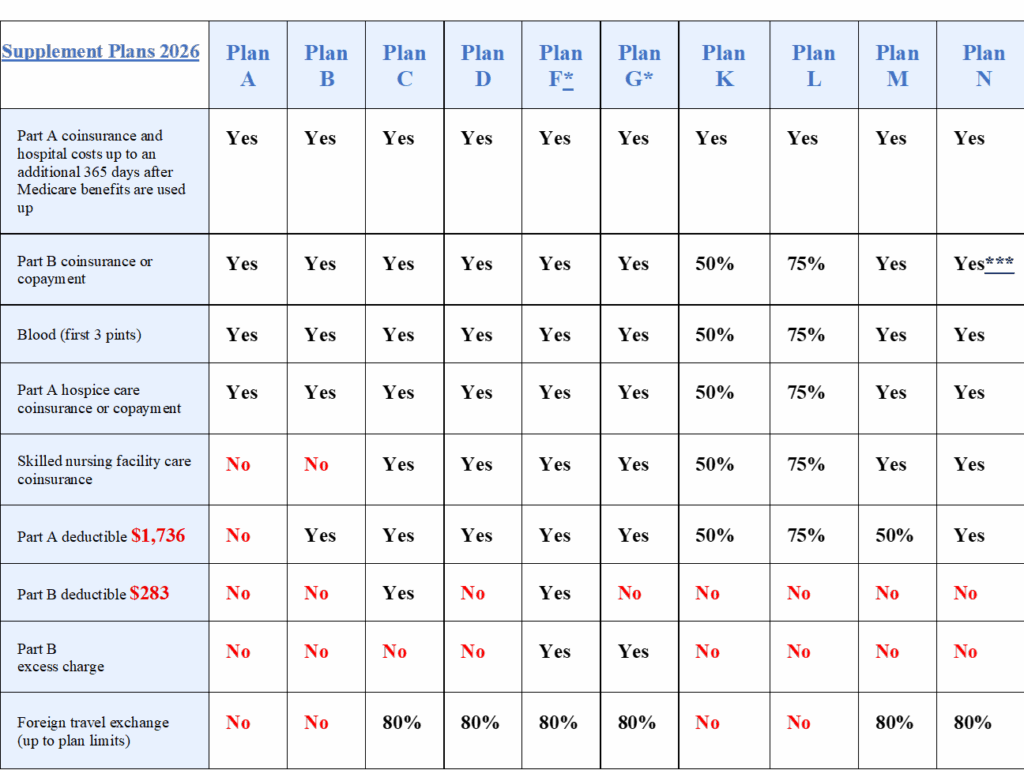

More Information about Supplement Plans

Compare Medigap Plans

Medigap (Supplement) policies are standardized.

Every Medigap policy must follow federal and state laws designed to protect you and be identified as “Medicare Supplement Insurance.” Insurance companies in most states can sell you only a “standardized” policy identified by letters, policy A, Policy B, etc.

Every policy, regardless of the insurer, has the same coverage. However, some policies provide additional benefits that may vary by insurance company.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A and Plan G if they offer any Medigap polices

Medigap Supplement Policies are “Pay Upfront” for services, meaning they have a monthly premium that must be paid. This differs from Medicare Advantage Plans (covered later), which are typically Pay-As-You-Go plans with little to no monthly premium payments.

Medigap Plan Comparison Chart

Below is a comparison of Medigap policies

Yes = covered expense

No = expense not covered

% = percentage of the cost covered

Out-of-pocket = Annual amount you must pay before the policy pays

Starting January 1, 2020, Medigap plans sold to new Medicare beneficiaries won’t be allowed to cover the Part B deductible. As a result, Plans C and F are no longer available to new Medicare enrollees starting January 1, 2020. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you’ll be able to keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans.

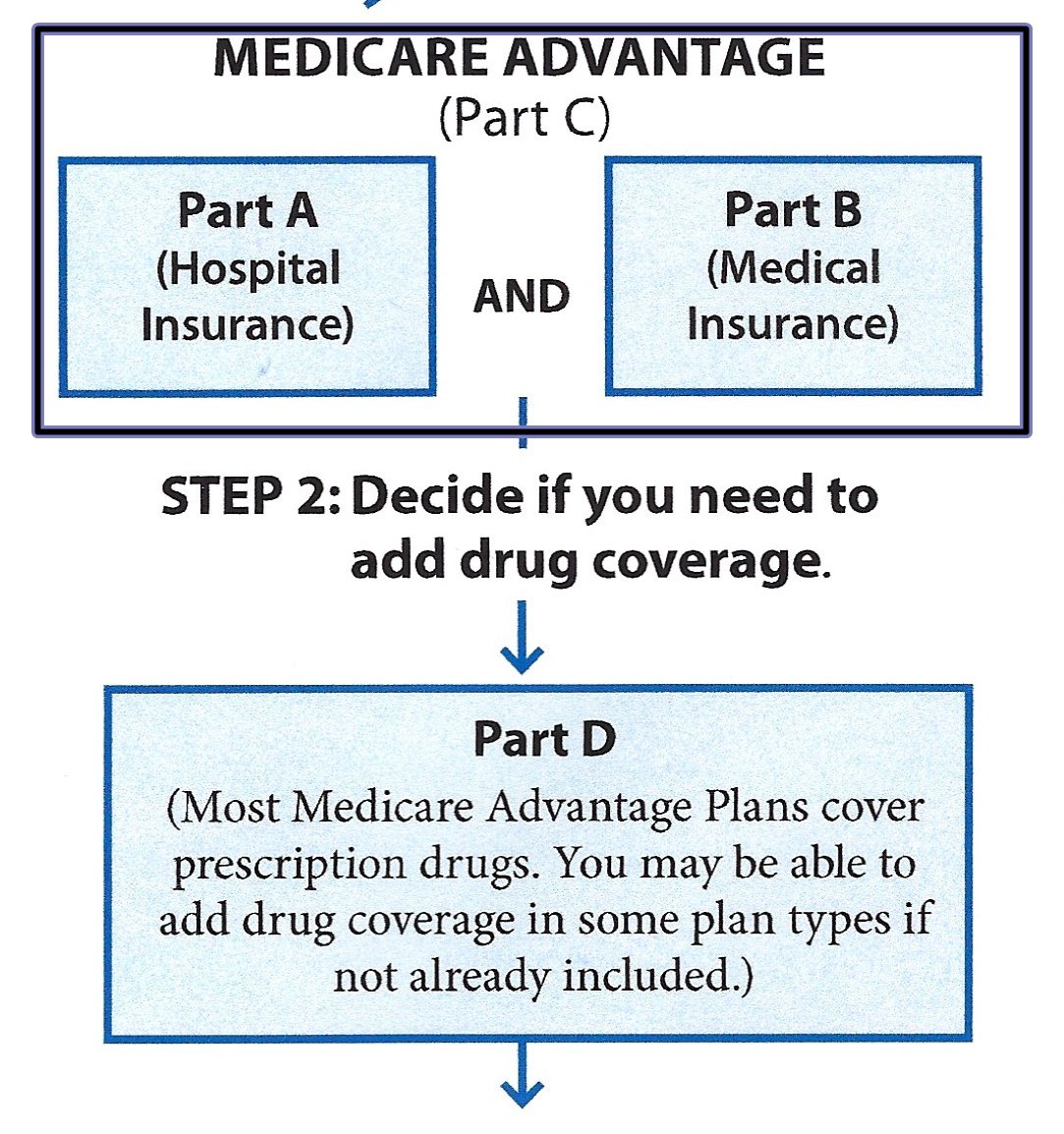

Medicare Advantage Plans – Right Side of Chart

A Better Choice?

For many Medicare clients, an Advantage Plan might be a better choice.

Another point about Advantage plans. Most Advantage plans include prescription drug coverage. However, some plans do not cover prescription drugs. Therefore, you may want to enroll in a Medicare Advantage Prescription Drug plan (MA-PD).

If you have a qualified prescription plan, such as Military health coverage, you may only want to purchase a Medicare Advantage plan that does not include prescription coverage. This gives you access to Part B (doctors, etc) and benefits outside your existing health plan. Please get in touch with your current healthcare representative and call me to discuss this further.

However, if your prescription plan is not qualified (such as with some employer health plans), I recommend you purchase a Medicare Advantage plan with prescription coverage to avoid a Part D penalty. Before making any of these moves, don’t hesitate to get in touch with your current healthcare representative to confirm that you have qualified Medicare coverage and ask for a summary of your plan’s coverage. I also suggest that you call me to discuss it further.

Remember, most Advantage plans include prescription drug coverage. Make sure the plan you are considering includes this coverage unless you are using the Part B benefits alongside your Group or Military health insurance policy..

If you are still confused, please complete the request form below or telephone me at my cell phone (561) 559-7153 — I promise to give you my greatest effort and honestly provide my best effort as you learn about Medicare and choose a plan that best fits your needs and budget. Together, we will make Medicare Easy!

START HERE: Get free Help from Don Now (1)

Free no obligation assistance & quotes

(561) 559-7153

Still Confused? Please let me help!

I am a Medicare Broker-Agent and also a Medicare Advisor. My business is to help you navigate the Medicare maze to “Make Medicare Easy!”

Call me at (561) 559-7153 or better yet, submit your name, phone number, and email address in the above “Get Free Medicare Assistance Now.”